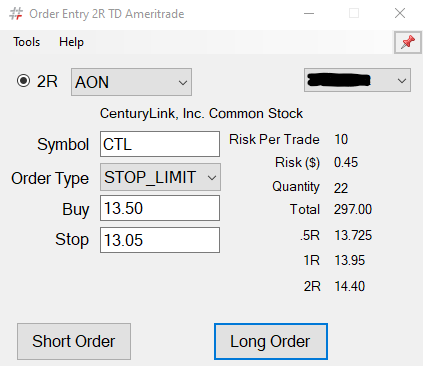

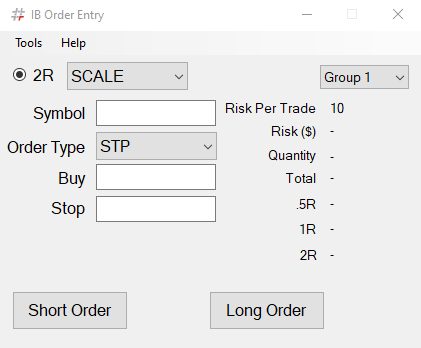

To use the risk to reward trading strategy with this bracket order day trading calculator, just enter the risk per trade ($), buy and stop price. By entering the 3 values it will calculate the quantity of shares and the profit price targets. Then these values would be entered into the bracket order entry screen your brokerage firm offers.

Long and Short Positions Trading

To take a long position in a stock ensure that the buy price is higher than stop price. To take a short position in a stock make sure that the buy price is lower than stop price.

Bracket Order Trading

You need a plan of price entry, profit targets and stop losses to define your risk for each day trade. By putting all three orders in the system at once will let you take profit when targets are hit or take a stop loss. In a bracket order the profit target and stop loss orders are linked together and One-Cancels-the-Other Order – (OCO). This will help protect the hard earn money in your trading account. The bracket order day trading calculator will help you stick to your trading plan. Download our Bracket Order Trader apps to simplify that bracket order entry.